House prices continue to fall in most OECD countries

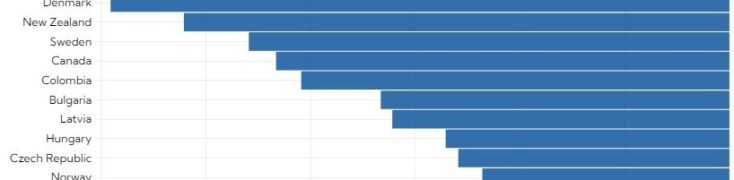

Global housing markets are retreating after years of steady increases. House prices in two-thirds of the economies surveyed by the Organisation for Economic Co-operation and Development (OECD) fell in the last quarter compared to the previous quarter. In 15 other countries, house prices continue to rise. Spain (-0.3%) has seen only a slight decline in prices compared to quarterly decreases of more than 5% in Denmark and New Zealand.

House prices continue to fall globally as borrowing costs rise. These movements underline how housing markets are adjusting to rising interest rates as central banks try to contain inflation.

Official rates have risen by an average of four percentage points in major economies, to levels similar to before the global financial crisis. “In the US, for example, the Federal Reserve has raised rates to a range of 4.5%-4.75% from near zero in barely a year, the fastest pace of rate hikes in two decades. This, in turn, led to a sharp increase in the average 30-year fixed mortgage rate, which rose to a two-decade high of 7.1% at the end of last year,” notes the International Monetary Fund (IMF).

Interest rates play a key role in driving house prices, along with income and population growth on the demand side, and also various factors such as construction costs and regulation on the supply side.

“There is a rule of thumb, based on evidence from several countries, that every one percentage point increase in real interest rates reduces the pace of house price growth by about two percentage points,” the IMF experts note.

Before this adjustment cycle, lower interest rates led to an increase in demand for housing by reducing the cost of borrowing to finance the purchase of a house or to build. Now the process is the reverse. Each one percentage point increase in the mortgage rate increases the monthly interest payment by $100 for a buyer in the US, and the impact may be more severe for buyers in countries where variable-rate mortgages predominate, such as Spain.

The duration of this fall in house prices will depend on whether central bank rate hikes have already reduced inflationary pressures. The latest IMF forecasts believe that inflation will be lower this year than in 2022 for about 85% of countries. Global inflation is expected to slow from almost 9% last year to around 6.5% this year, and to stabilise further next year.

“If central banks reduce or pause rate hikes, house prices should become more stable,” the agency says.